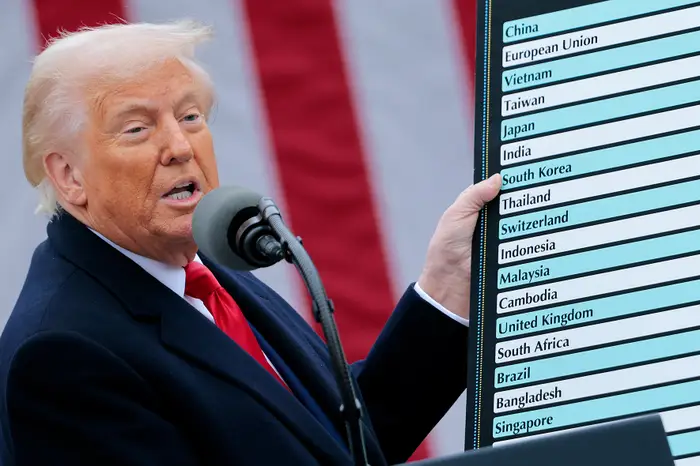

Trump tariffs India markets: Beginning in 2018, the Trump administration unleashed a broad trade war. It slapped 25% tariffs on imported steel and 10% on aluminum, then applied a 10% surcharge on nearly all imports and much higher rates on key partners. By April 2025, the US announced “reciprocal” tariffs targeting India (26%) along with China (54%), the EU (20%), Japan (24%) and others. These moves pushed America’s average import duty to the highest level since World War II, sparking fears of a prolonged global recession. The World Trade Organization’s Pamela Coke-Hamilton warned that the turmoil could shrink world trade by about 3%, as supply chains reorient toward India, Brazil and other emerging markets. In short, the new tariffs have dramatically raised prices and uncertainties worldwide, fueling volatile reactions in India.

Impact on Indian Markets (Short Term)

Indian stock markets plunged on news of the tariffs. BSE Sensex and Nifty 50 dropped about 5% in a single session – one of the worst falls in years. By April 7, 2025, BSE market capitalization had lost over ₹14–19 lakh crore (trillions of rupees). Broad indices were dragged down by heavy selling in companies tied to the US economy. For example, Tata Group firms (large US exposure) saw their combined market value shrink by ~₹2.4 lakh crore. Other sectors hit hard included automobiles, metals, IT services, pharmaceuticals, textiles and gems.

Economists attribute this sell-off to panic over higher import costs and slower export demand. Foreign funds withdrew from Indian equities, and investors sought safer assets. Gold prices and government bonds rallied while the rupee slid to multi-month lows under the pressure. Analysts note that companies with large U.S. business (consumer goods, tech services, etc.) saw the steepest declines, as investors “offloaded shares of companies with US exposure” amid fears of a worldwide downturn. Overall, the tariff shock triggered a bout of extreme volatility in Indian markets, wiping out years of gains in days.

Stock Market Reaction

Investors immediately turned bearish. Indian equities were hit by a wave of margin calls and panic selling. On April 7, 2025 Sensex and Nifty each fell roughly 5% in one day, only recovering some losses at the close. That “Black Monday” erased decades of gains for the day, costing the average investor ₹14.2 lakh crore. The drop was broad-based: every sectoral index saw multi-percentage declines, led by auto, metal, IT, pharma, textiles and gems. Notably, firms with strong US revenue streams were sold off most aggressively.

This turmoil drove foreign portfolio outflows and a scramble for safe havens. The Bombay Stock Exchange warned that any global recovery or tariff roll-back could quickly reverse the slide. Meanwhile, credit markets priced in higher risk: corporate bond spreads ticked up slightly and banks reported caution in new loans. Commodity prices also reacted – oil dipped on growth worries, while gold climbed as investors sought protection. Analysts emphasize that much of this damage is due to sentiment – fundamentals have not yet fully changed – suggesting a possible rebound if tensions ease.

India–US Trade Relations & Retaliation

India’s trade with the US is significant: bilateral trade exceeds $190 billion/year, with India running a ~$50 billion surplus. American officials point out that India’s average tariff on US goods (~17%) far exceeds the US rate (~3%). Washington justified its tariffs as “reciprocal” measures to correct this imbalance.

In practice, India has limited ability to retaliate symmetrically. A U.S. think-tank notes that many Indian imports (pharmaceuticals, certain foods) are low or zero-duty in the US. Nonetheless, India originally announced its own tariffs on $900 million of US agricultural exports (apples, almonds, etc.) in response to 2018 steel and aluminum tariffs. Those duties were to mirror US rates but have been largely shelved pending talks. For now, India is instead lobbying Washington (through WTO and diplomacy) to avoid a trade war. Prime Minister Modi’s government stresses that India and the US are “friends” and is seeking exemptions or a limited deal. In April 2025 the US paused additional duties on some Indian exports for 90 days (until July) in exchange for ongoing talks.

Still, bilateral relations are under strain. The US-China conflict and shifting alliances mean India must balance strategic partnership with protection of its own industries. Policymakers in New Delhi are unlikely to lower their tariffs easily – the very reason Trump imposed them in the first place. Any future concessions (on visas, data flows, etc.) may be tied to trade. In short, India is playing a delicate game: protecting exporters in the short term, while negotiating with the US to avoid an escalation.

International Comparisons

India is not alone. China has been the main target of Trump’s trade campaign. Beijing now faces an effective 54% average tariff on its exports, and has retaliated in kind – imposing duties on around 800 US goods, totaling ~$20.6 billion in 2018 alone. In early April 2025 China announced a 34% tariff on all US imports in response to the new US levies, prompting Trump to threaten a cumulative 104% tariff if China does not back down. Stock markets in Hong Kong, Shanghai and Taiwan dropped more than 7–9% in one day, illustrating the contagion.

The EU and U.S. have a more mixed legacy. In 2018, when Trump slapped metal tariffs, Europe protested via the WTO and imposed ~$3.6 billion of counter-tariffs. By 2021 the Biden administration lifted those sanctions. However, under the new plan the EU was hit with ~20% on many goods. Canada and Mexico – originally exempt from steel/aluminum tariffs – eventually agreed to USMCA (replacing NAFTA) and saw those duties removed by mid-2019. In this latest round, North American trade flows aren’t directly affected (the new US plan excluded USMCA countries), but Mexico’s factories do feel higher costs on Chinese inputs.

Across the Indo-Pacific, most countries (aside from China) have so far avoided immediate retaliation. Governments are instead exploring strategies like diversifying export markets, cutting domestic tariffs and engaging with Washington bilaterally. For example, Vietnam and ASEAN exporters are shifting sales to Europe, Korea and the Middle East. A recent survey warns that unless global tensions ease, many economies could face long-term slowdowns and a fracturing of trade links.

Geopolitical & Economic Shifts

Trump’s tariff policy – and the uncertainty around it – is catalyzing broader changes. Some emerging economies could gain export share as supply chains move out of China. Indeed, experts forecast that a lasting 3% drop in global trade would redistribute exports toward countries like India and Brazil. India may attract more foreign investment in manufacturing as companies look for alternatives, though high Indian tariffs remain a hurdle. Domestically, the shock strengthens voices calling for reforms: lower import duties, faster infrastructure spending and new trade deals to insulate the economy.

Geopolitically, the US moves have weakened trust in multilateral trade rules. The Administration’s tariff actions have prompted complaints to the WTO and may bolster rival trade blocs (e.g. China’s Regional Comprehensive Economic Partnership). Meanwhile, the Sino-US trade war and fears of “decoupling” have driven closer security ties between India and the US (Quad) – but also encourage India to hedge by deepening trade links with Europe, the Middle East and Russia. In sum, American tariffs are not just an economic lever but a strategic signal: that the global order is shifting to a more competitive, less cooperative era.

Outlook

In the short term, India’s markets will likely remain jittery. Analysts caution that inflation (from higher import prices) and slower growth are possible outcomes. However, many Indian exporters are already accustomed to volatility, and sectors like pharmaceuticals and IT services have some insulation. If a negotiated compromise emerges (or if tariffs are delayed), a sharp rebound in markets is possible. Longer-term, the experience may prod India to ease some trade barriers and accelerate moves toward a free-market economy – changes that could ultimately bolster resilience.

Ultimately, Trump’s tariff barrage has shaken Indian markets and tested policymakers, but it has also underscored India’s role as a rising middle power. How New Delhi responds – through diplomacy, industry support and reforms – will shape its economic fortunes in a post-2025 world.

Related articles

Trump Tariffs 2025: Economic Impact on India, China & Beyond