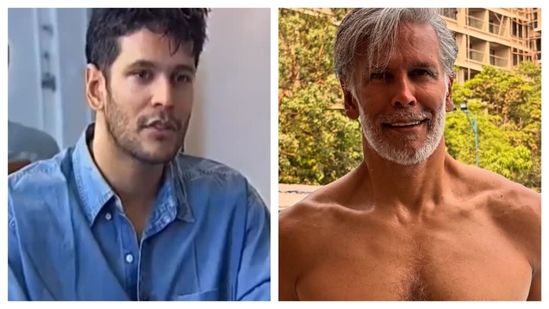

Honestly, when you hear the word ‘diet’, the first thing that comes to mind is salads, protein shakes, or some expensive fancy meal plans. But then you look at someone like Milind Soman, and you realise… maybe it’s not that complicated after all.

This man, even after crossing 50, looks fitter than most 25-year-olds. And what’s interesting? His food habits are almost too simple to believe. No drama, no superfoods from abroad, just the kind of food we have been eating since childhood.

He had shared once on his Instagram about what he eats daily, and believe me, it’s as basic as it can get. Let’s just sit and talk about it today.

First, a little about Milind Soman

If you were growing up in the 90s, chances are you saw him in that Made in India music video and thought, “This guy is something else.” Over the years, he became not just a model or actor but also a serious fitness inspiration. Runs marathons barefoot, swims across rivers, does Ironman competitions — he’s done it all.

But the surprising part? His daily routine is more about simple discipline than any crazy fitness obsession. His food is proof of that.

What does Milind actually eat in a day?

Morning Kickstart

First thing he does is drink half a litre of water. No lemon squeezed into it, no chia seeds floating inside just plain, old-school water. It’s something most of us can do without even spending a single rupee extra.

Breakfast (around 10 AM)

Instead of heavy parathas or sandwiches, he picks fruits. Seasonal ones mostly papaya, melon, mango if it’s summer time. Along with that, a small handful of almonds or walnuts. That’s it. No fancy smoothie bowls or oats jars you see everywhere on Instagram these days.

Lunch Time (around 2 PM)

Lunch is good old Indian homemade food. Mostly khichdi, the humble mixture of rice, dal, and veggies, sometimes chapati, sabzi, and dal with a spoon of ghee on top. Simple, filling, and honestly, comforting too.

Non-vegetarian food? Rarely. Maybe once in a month a little bit of chicken, mutton, or eggs if he feels like it. But otherwise, pure vegetarian home-style meals.

Tea Time

Around 5 PM, if he feels like it, he has black tea with a bit of jaggery. No white sugar. Just a hint of sweetness in the healthiest way possible.

Dinner

Dinner is pretty much a lighter version of lunch again, khichdi or roti with vegetables. No heavy curries or deep-fried items.

Before Sleeping

At night, he sips a cup of hot water mixed with turmeric and jaggery. A simple old home remedy that helps in digestion and keeping the system clean.

Why it actually works

See, the thing is it’s not about eating less or skipping meals. It’s about eating real food. Things that are grown around us, food that our body actually understands.

No fancy diets with names we can’t even pronounce. No protein powders imported from halfway across the world. Just the kind of food our parents and grandparents always trusted.

Plus, he listens to his body. Eats when he is hungry. Stops when he feels full. No calorie counting madness.

Feels like coming back home, doesn’t it?

Honestly, when you look at Milind’s meals, it feels familiar. Like home. Khichdi after a tiring day, hot water before bed, fruits in the morning — these are the small habits we grew up with but somehow left behind in the rush of modern life.

Maybe we thought we needed complicated solutions. But maybe, we just needed to trust the basics a little more.

What we can learn from Milind

Eat local and seasonal.

Keep your meals simple.

Hydrate well.

Move your body every day.

And most importantly, don’t overthink food.

Final Thoughts

You know, it’s easy to get trapped in the world of crash diets and ‘5-minute abs’ promises. But the truth is, health is very simple.

If Milind Soman, one of the fittest people around, is thriving on khichdi, fruits, and water, then maybe we don’t need anything fancier either.

Maybe next time when you’re planning a meal, instead of scrolling through complicated diet plans online, you can just pick up that simple plate of dal-chawal your mother cooked.Because sometimes, old ways are the best ways.

Liked this post? Then you’ll probably love this as well: Healthline – 7 Indian Foods That Boost Immunity

Interested in this? You’ll also want to read: 7 Simple Morning Habits That Actually Help Your Mental Health